Tourism Development Financing Program

— Is there a sector of local tourism activity in your area which has reached such high demand, that current tourism product cannot meet?

— Does your current, updated Community Comprehensive Plan identify and address these demands?

— Do your current, updated Tourism Development Plan and Tourism Marketing Plan identify, benchmark and track traveler visitation, activity and visitor spending?

— Do potential Developer partners have a current Market / Feasibility Study with research and data proving their project can fill that local Deficiency?

— If you’ve answered “Yes” to these key tenants of tourism development and marketing, then the Commonwealth’s Tourism Development Financing Program (TDFP) may be a consideration for your community.

Review > TDFP Overview PPT

DEFICIENCY

These deficiencies are well researched and substantiated in a community’s Comprehensive Community Plan, a Local Tourism Development Plan and through independent Market Studies. Prospective projects filling such deficiencies must generate Virginia sales and use tax, such as lodging, dining, meeting space rental and catering. Projects collecting only admissions tax are not eligible, since the State does not collect admissions tax, therefore, nothing to contribute to the project.

THE DEVELOPER’S GAP FINANCING

- Think of TDFP as a Tax Rebate

- The Developer acquires all the lending they need, opens and generates revenue

- The State and Municipality collect new tax, and give back a portion toward the project’s gap debt

- Much like TIF (Tax Incremental Financing,) TDFP is a program where both Municipality and State divert and contribute future sales tax revenues towards the Developer’s debt with the Lender

- Once a certified project is open and generating revenue, a Locality, the Developer and the State divert and contribute future sales tax revenues towards the Developer’s debt with the Lender

- Before the project begins construction, the Applicant/Locality must receive TDFP certification

In the TDFP program, the Locality is the Applicant, not the Developer

The purpose of the program is to provide a gap financing mechanism for projects that cannot, otherwise, find 100% funding or lending for a project

The Developer assumes all debt with Lenders. If a Locality’s deficiency is proven, the Developer must secure all the lending required to finance the project, with the agreement that the State, Locality and Developer will each pay an equal third of the Developer’s gap financing loan to the gap Lender

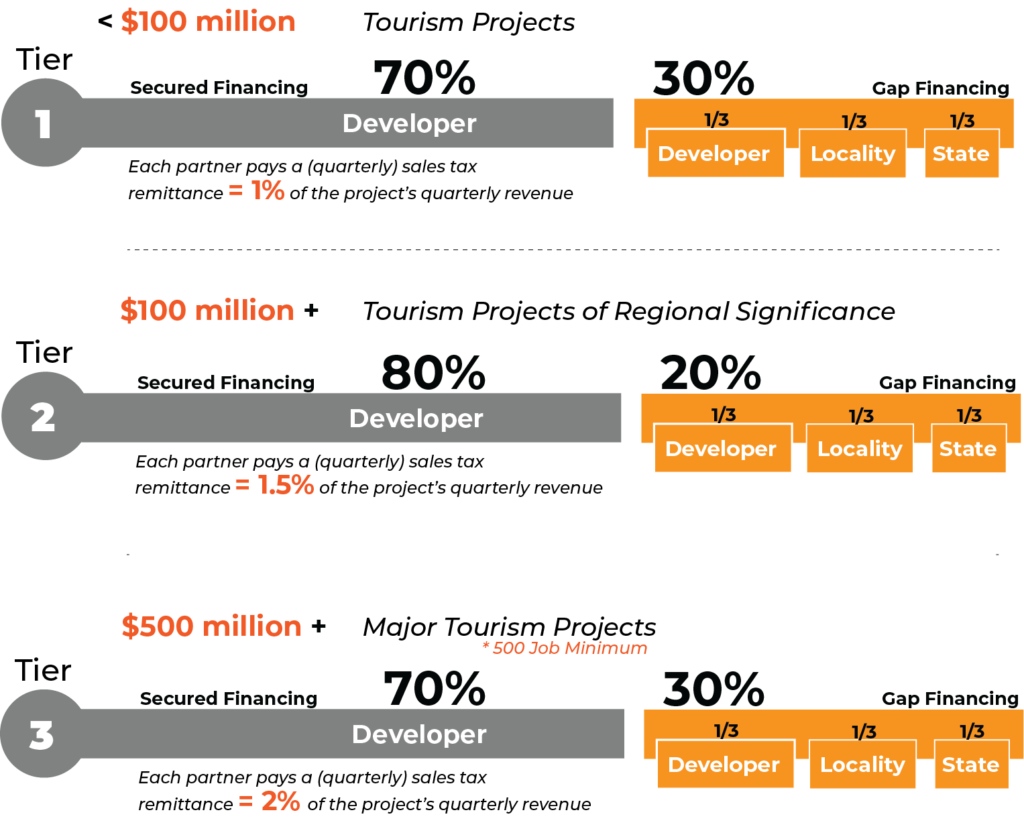

The TDFP provides three different tiers of financing to compensate for a shortfall in project funding. Eligible projects with a total cost of less than $100 million fall into Tier (1), eligible projects with a total cost of $100 million or more fall into Tier (2); while Tier (3) projects have a capital investment of $500+ million. The image below highlights the program’s three tiers of financing

The image below outlines an example of a Tier (1) TDFP payment process once the qualified business has opened and started generating revenue